-40%

QUICKBOOKS PRO 2020 Training Tutorial DVD & Digital Course 189 Videos 7.5 Hours

$ 7.91

- Description

- Size Guide

Description

QUICKBOOKS PRO 2020 Training Tutorial DVD & Digital Course 189 Videos 7.5 HoursQUICKBOOKS PRO 2020 Training Tutorial DVD & Digital Course 189 Videos 7.5 Hours

Mastering QuickBooks Made Easy Digital Self-Study Training Course

DVD-ROM and Digital Course. We grant you fast access while your DVD-ROM is shipped.

Within one business day following purchase, you will receive a message from us through the eBay messaging system that contains your login credentials and instructions to download your course from our site. The course downloads to your PC or Mac and is yours to keep. You will also receive one year online access to the course that you can view from any computer or mobile device with an internet connection. We will then ship a hard copy of your DVD-ROM to your confirmed eBay shipping address.

Product Details:

Product Name:

Mastering QuickBooks Desktop Pro Made Easy

Manufacturer:

TeachUcomp, Inc.

Versions Covered:

2020 Desktop Pro

Course Length:

7.5 Hours

Video Lessons:

189

Instruction Manuals:

1 (PDF- 296 Pages)

Product Type:

DVD-ROM, Download Online Access

Learn QuickBooks Pro 2020 with this comprehensive course from TeachUcomp, Inc.

Mastering QuickBooks Made Easy features 189 video lessons with over 7.5 hours of introductory through advanced instruction. Watch, listen and learn as your expert instructor guides you through each lesson step-by-step. During this media-rich learning experience, you will see each function performed just as if your instructor were there with you. Reinforce your learning with the text of our printable classroom instruction manual (Introductory and Advanced), additional images and practice exercises. You will learn how to set up a QuickBooks company file, pay employees and vendors, create custom reports, reconcile your accounts, use estimating, time tracking and much more.

Whether you are completely new to QuickBooks or upgrading from an older version, this course will empower you with the knowledge and skills necessary to be a proficient user. We have incorporated years of classroom training experience and teaching techniques to develop an easy-to-use course that you can customize to meet your personal learning needs. Simply launch the easy-to-use interface, click to start a video lesson or open one of the manuals and you’re on your way to mastering QuickBooks.

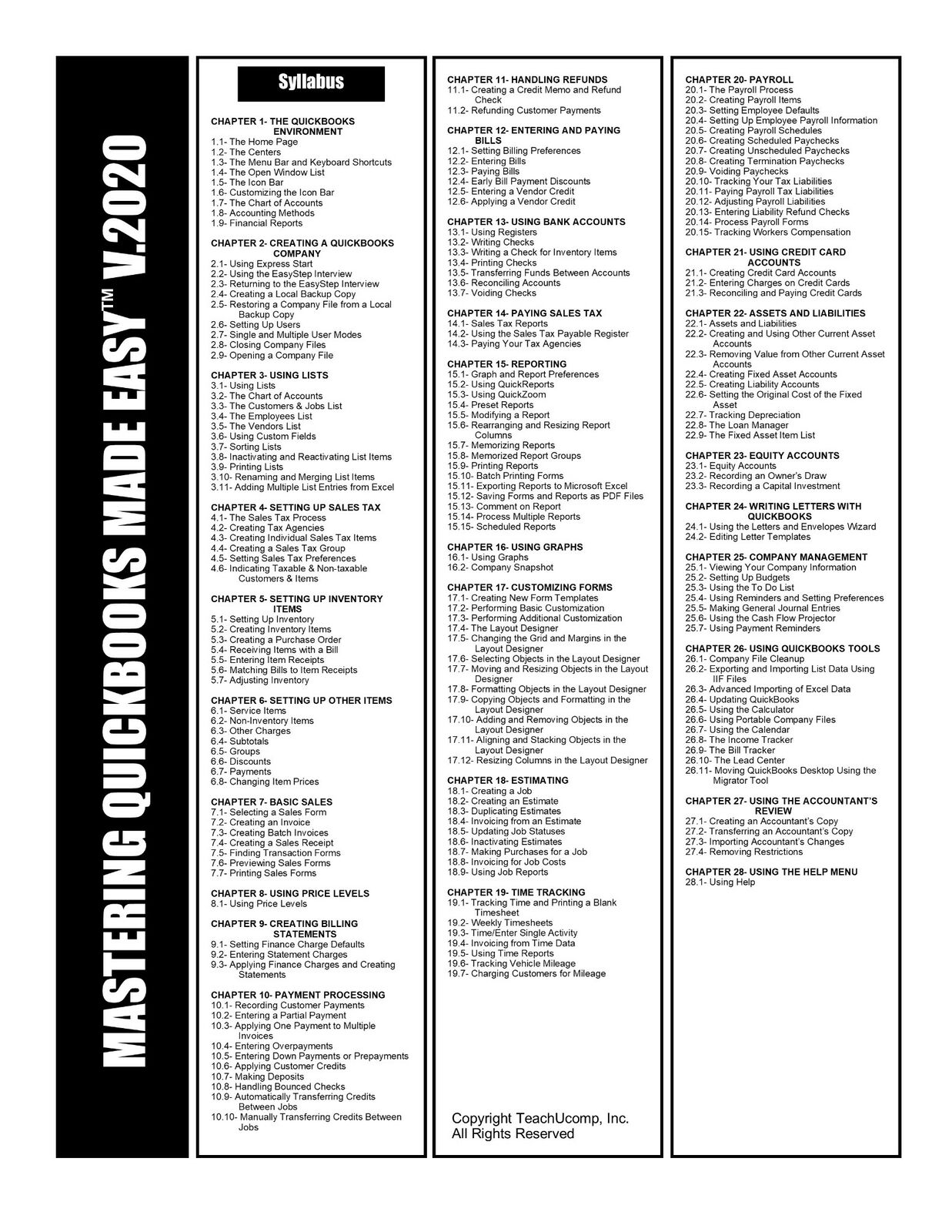

Topics Covered:

The QuickBooks Environment

1. The Home Page and Insights Tabs

2. The Centers

3. The Menu Bar and Keyboard Shortcuts

4. The Open Window List

5. The Icon Bar

6. Customizing the Icon Bar

7. The Chart of Accounts

8. Accounting Methods

9. Financial Reports

Creating a QuickBooks Company File

1. Using Express Start

2. Using the EasyStep Interview

3. Returning to the Easy Step Interview

4. Creating a Local Backup Copy

5. Restoring a Company File from a Local Backup Copy

6. Setting Up Users

7. Single and Multiple User Modes

8. Closing Company Files

9. Opening a Company File

Using Lists

1. Using Lists

2. The Chart of Accounts

3. The Customers & Jobs List

4. The Employees List

5. The Vendors List

6. Using Custom Fields

7. Sorting List

8. Inactivating and Reactivating List Items

9. Printing Lists

10. Renaming & Merging List Items

11. Adding Multiple List Entries from Excel

Setting Up Sales Tax

1. The Sales Tax Process

2. Creating Tax Agencies

3. Creating Individual Sales Tax Items

4. Creating a Sales Tax Group

5. Setting Sales Tax Preferences

6. Indicating Taxable & Non-taxable Customers and Items

Setting Up Inventory Items

1. Setting Up Inventory

2. Creating Inventory Items

3. Creating a Purchase Order

4. Receiving Items with a Bill

5. Entering Item Receipts

6. Matching Bills to Item Receipts

7. Adjusting Inventory

Setting Up Other Items

1. Service Items

2. Non-Inventory Items

3. Other Charges

4. Subtotals

5. Groups

6. Discounts

7. Payments

8. Changing Item Prices

Basic Sales

1. Selecting a Sales Form

2. Creating an Invoice

3. Creating Batch Invoices

4. Creating a Sales Receipt

5. Finding Transaction Forms

6. Previewing Sales Forms

7. Printing Sales Forms

Using Price Levels

1. Using Price Levels

Creating Billing Statements

1. Setting Finance Charge Defaults

2. Entering Statement Charges

3. Applying Finance Charges and Creating Statements

Payment Processing

1. Recording Customer Payments

2. Entering a Partial Payment

3. Applying One Payment to Multiple Invoices

4. Entering Overpayments

5. Entering Down Payments or Prepayments

6. Applying Customer Credits

7. Making Deposits

8. Handling Bounced Checks

9. Automatically Transferring Credits Between Jobs

10. Manually Transferring Credits Between Jobs

Handling Refunds

1. Creating a Credit Memo and Refund Check

2. Refunding Customer Payments

Entering and Paying Bills

1. Setting Billing Preferences

2. Entering Bills

3. Paying Bills

4. Early Bill Payment Discounts

5. Entering a Vendor Credit

6. Applying a Vendor Credit

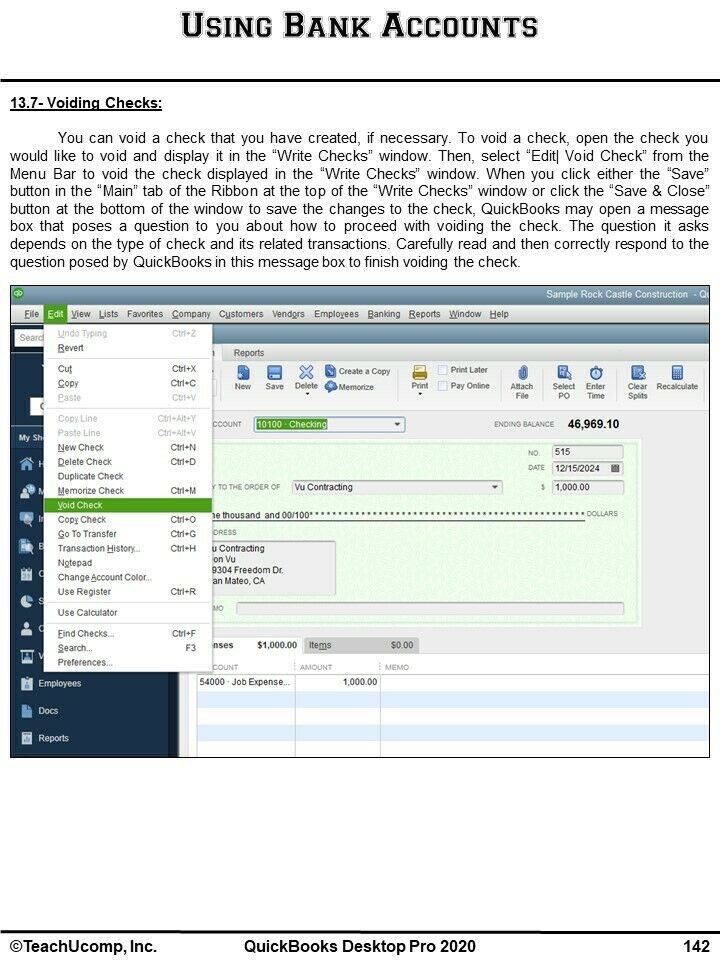

Using Bank Accounts

1. Using Registers

2. Writing Checks

3. Writing a Check for Inventory Items

4. Printing Checks

5. Transferring Funds

6. Reconciling Accounts

7. Voiding Checks

Paying Sales Tax

1. Sales Tax Reports

2. Using the Sales Tax Payable Register

3. Paying Your Tax Agencies

Reporting

1. Graph and Report Preferences

2. Using QuickReports

3. Using QuickZoom

4. Using Preset Reports

5. Modifying a Report

6. Rearranging and Resizing Report Columns

7. Memorizing a Report

8. Memorized Report Groups

9. Printing Reports

10. Batch Printing Forms

11.Exporting Reports to Excel

12. Saving Forms and Reports as PDF Files

13. Comment on Report

14. Process Multiple Reports

15. Scheduled Reports

Using Graphs

1. Using Graphs

2. Company Snapshot

Customizing Forms

1. Creating New Form Templates

2. Performing Basic Customization

3. Performing Additional Customization

4. The Layout Designer

5. Changing the Grid and Margins in the Layout Designer

6. Selecting Objects in the Layout Designer

7. Moving and Resizing Objects in the Layout Designer

8. Formatting Objects in the Layout Designer

9. Copying Objects and Formatting in the Layout Designer

10. Adding and Removing Objects in the Layout Designer

11. Aligning and Stacking Objects in the Layout Designer

12. Resizing Columns in the Layout Designer

Estimating

1. Creating a Job

2. Creating an Estimate

3. Duplicating Estimates

4. Invoicing From Estimates

5. Updating Job Statuses

6. Inactivating Estimates

7. Making Purchases for a Job

8. Invoicing for Job Costs

9. Using Job Reports

Time Tracking

1. Tracking Time and Printing a Blank Timesheet

2. Weekly Timesheets

3. Time/Enter Single Activity

4. Invoicing from Time Data

5. Using Time Reports

6. Tracking Vehicle Mileage

7. Charging Customers for Mileage

Payroll

1. The Payroll Process

2. Creating Payroll Items

3. Setting Employee Defaults

4. Setting Up Employee Payroll Information

5. Creating Payroll Schedules

6. Creating Scheduled Paychecks

7. Creating Unscheduled Paychecks

8. Creating Termination Paychecks

9. Voiding Paychecks

10. Tracking Your Tax Liabilities

11. Paying Your Payroll Tax Liabilities

12. Adjusting Payroll Liabilities

13. Entering Liability Refund Checks

14. Process Payroll Forms

15. Tracking Workers Compensation

Using Credit Card Accounts

1. Creating Credit Card Accounts

2. Entering Credit Card Charges

3. Reconciling and Paying Credit Cards

Assets and Liabilities

1. Assets and Liabilities

2. Creating and Using an Other Current Asset Account

3. Removing Value from Other Current Asset Accounts

4. Creating Fixed Asset Accounts

5. Creating Liability Accounts

6. Setting the Original Cost of the Fixed Assets

7. Tracking Depreciation

8. The Loan Manager

9. The Fixed Asset Item List

Equity Accounts

1. Equity Accounts

2. Recording an Owner's Draw

3. Recording a Capital Investment

Writing Letters With QuickBooks

1. Using the Letters and Envelopes Wizard

2. Editing Letter Templates

Company Management

1. Viewing Your Company Information

2. Setting Up Budgets

3. Using the To Do List

4. Using Reminders and Setting Preferences

5. Making General Journal Entries

6. Using the Cash Flow Projector

7. Using Payment Reminders

Using QuickBooks Tools

1. Company File Cleanup

2. Exporting and Importing List Data Using IIF Files

3. Advanced Importing of Excel Data

4. Updating QuickBooks

5. Using the Calculator

6. Using the Portable Company Files

7. Using the Calendar

8. The Income Tracker

9. The Bill Tracker

10. The Lead Center

11. Moving QuickBooks Desktop Using the Migrator Tool

Using the Accountant's Review

1. Creating an Accountant's Copy

2. Transferring an Accountant's Copy

3. Importing Changes to Your Company File

4. Removing Restrictions

Using the Help Menu

1. Using Help

Minimum System Requirements:

1 GHz Intel Pentium Processor or equivalent

Windows or MAC

DVD-ROM Drive

1 GB RAM

256 color SVGA capable of 1024x768 resolution

Speakers or headphones

High Speed Internet Connection

Payment

Shipping

Returns

Contact

We accept

PayPal

for all orders- the safest way to shop on eBay.

Digital Items:

No shipping means fast access to your course.

Within one business day following purchase, you will receive a message from us through the eBay messaging system that contains your login credentials and instructions to access your course from our site.

Physical Products:

We offer

FREE shipping

U.S. orders.

Your order will be shipped within 1 business day of receiving payment (Monday-Friday).

In the very unlikely event that your item is lost or damaged during shipment, please be sure to let us know. We will issue either a full refund or replacement.

If you are not 100% satisfied with your purchase, you can return the product and get a full refund (minus any shipping costs) or exchange the product for another one.

You can return a product for up to 30 days from the date you purchased it.

Any physical product you return must be in the same condition you received it and in the original sealed packaging.

Please use the eBay message center to contact us. This assures that we receive your message. We are open Monday through Friday 9-5 Eastern and will answer you within one business day.

We're always happy to answer questions. We want to make your buying experience as pleasurable as possible.

Listing and template services provided by inkFrog